Gold projects' operating costs up 50%

Gold projects' operating costs have risen by more than half in four years, according to data compiled by Mining Journal Intelligence (MJI).

While industry eyes have been focused on gold's above US$3000/oz, costs have continually crept up, according to an analysis of the latest economic studies at 180 primary gold projects globally.

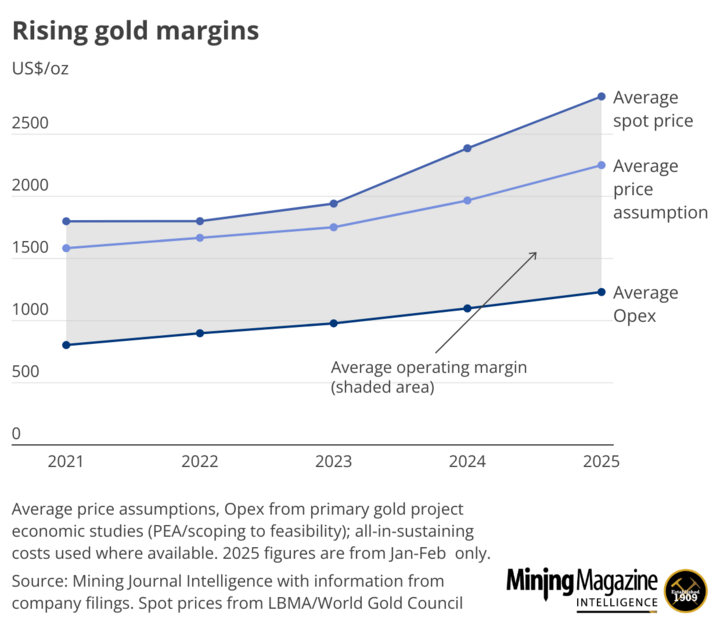

Average operating costs (all-in-sustaining costs or AISCs) stood at $803/oz in 2021 but have climbed every year since, reaching a high of $1230/oz in January-February 2025 – a rise of 53.2%.

The data was taken from MJI's Project Pipeline Index Database (PPI Database), which underpins the Project Pipeline Index report, profiling our top 50 projects globally (the 2025 edition is due out in the coming months).

Figures are sourced from studies ranging from the PEA/scoping to feasibility levels. The 180 studies outlined projects capable of producing 23.7Mozpa gold for combined initial capex totalling $58.8 billion.

Of the 180 studies, 14 were from early 2025, with 50 from last year, 51 from 2023, 42 from the previous year and 23 from 2021.

Margins boost

While operating costs have risen, gold prices had increased by a similar rate by early 2025, from about $1800/oz in 2021-2022 to an average of $2803/oz in January-February, a 55.7% rise. At the close of trading on April 23, gold's gains since 2021-2022 were north of 80.0%, at $3263/oz.

Operating margins – average prices minus AISCs – were $996/oz in 2021, or 55.4%. While margins had increased to $1573/oz by early 2025, the percentage remained relatively stable at 56.1%.

Applying the current spot price of $3263/oz to the average AISCs in the January-February studies gives an operating margin of $2033/oz, or 62.3%.

Rising price assumptions

While average price assumptions used in economic studies have remained below spot prices since 2021, they have also risen substantially.

In the 2021 studies, the average assumed gold price used to calculate economic returns was $1582/oz. By 2024, this had risen to $1966/oz, with a further surge to $2250/oz in 2025 studies.

Profitable outlook

While copper has disappointed and lithium and nickel markets have declined, gold has been a positive performer, delivering a massive windfall for producers.

Although gold project operating costs have risen significantly since 2021, higher prices have boosted potential margins, with the average project generating positive margins at less than half the current spot price.

A sustained drop in prices to $2000/oz, however, would erode returns compared to the assumptions in economic studies in early 2025, although some analysts see further gains to come, with JP Morgan forecasting a jump to $4000/oz prices by Q2, 2026.

By Sam Williams

We would love to hear your feedback!

Please email sam.williams@aspermont.com with any questions, suggestions, or comments about our research.